VisaVisa visa A leading global payment technology company connecting consumers, businesses, and banks. Dispute Monitoring Program (VDMP). This went into effect October 1, 2019. For the Visa Dispute Monitoring Program, what has historically been called “first chargebackChargeback chargeback A dispute raised by the cardholder that results in reversal of a transaction. Can lead to penalties for merchants.” is now referenced as “dispute.”

Overview

Visa implemented their chargeback and fraudFraud fraud Criminal deception involving unauthorized payments or use of financial credentials. compliance programs to mitigate excessive disputes and fraud activity. Ultimately, Visa expects merchants to maintain low chargeback and fraud rates so that the integrity of their network is preserved. This post will cover the following:

- Updates to the Visa Dispute Monitoring Program (effective October 1, 2019)

- Updates to the Visa Fraud Monitoring Program (effective October 1, 2019)

- Visa Fraud Monitoring Program — 3DS

- Program transaction caps

- Remediation plan

- Common questions

Visa Dispute Monitoring Program (VDMP) updates

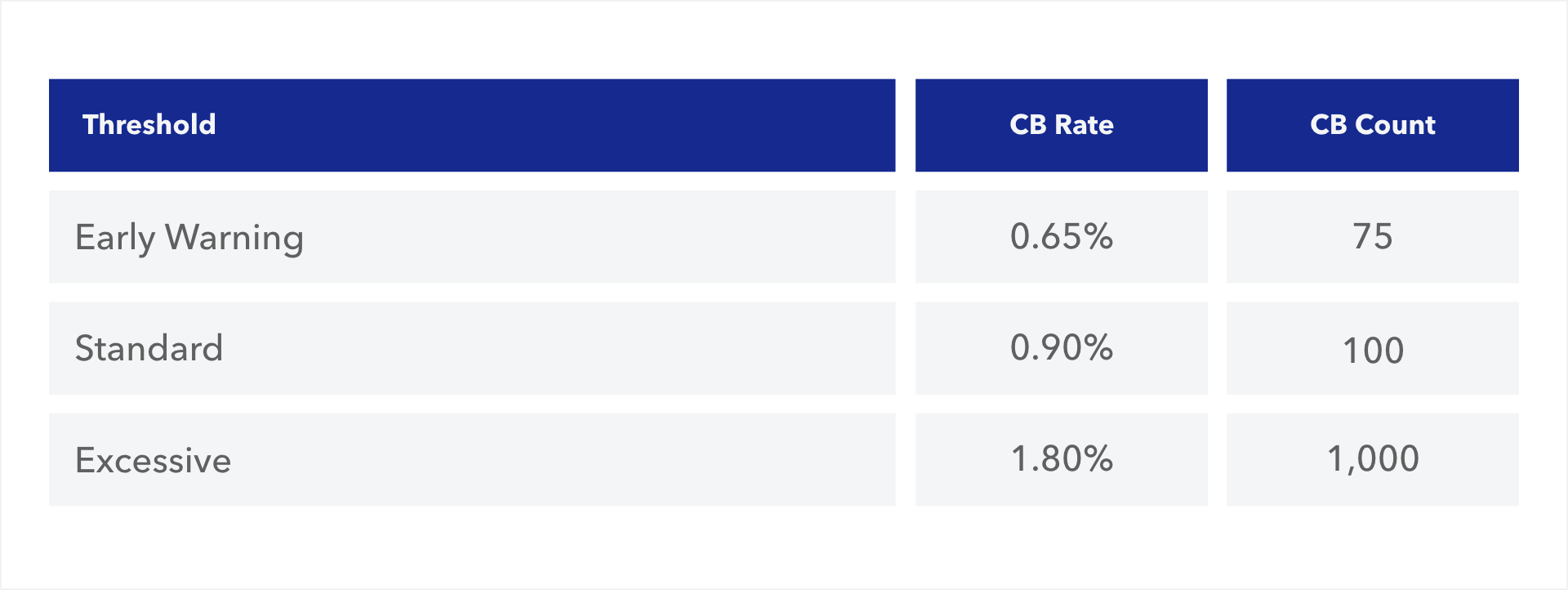

Updated thresholds — effective October 1, 2019

The VDMP reviews a merchantMerchant merchant An individual or business that accepts payments in exchange for goods or services. account’s previous month’s chargeback activity count and divides over that month’s transaction sales count.

Starting in October 2019, if an account’s chargebacks meet or exceed the following thresholds, the account will be entered into the corresponding Visa program:

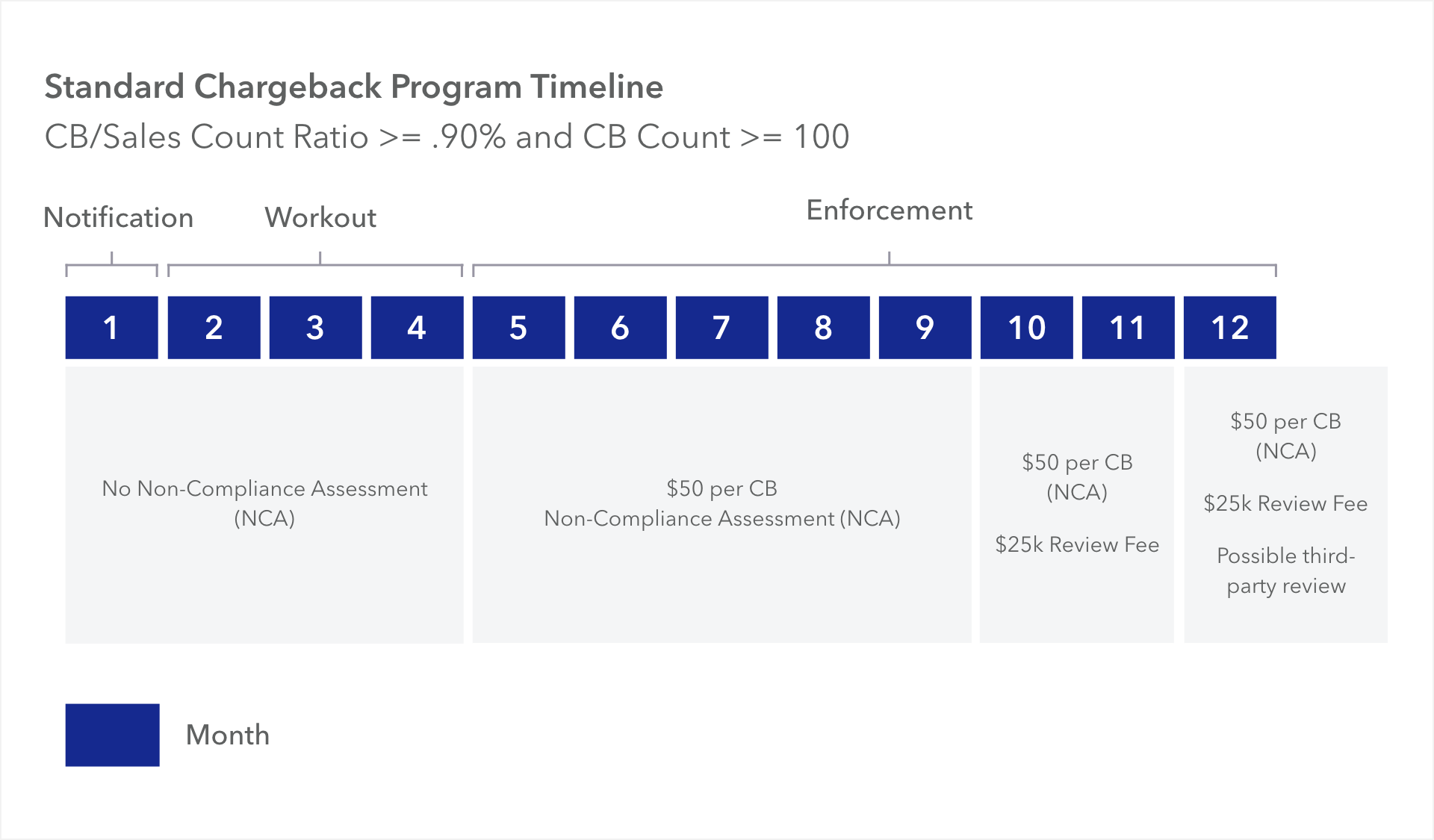

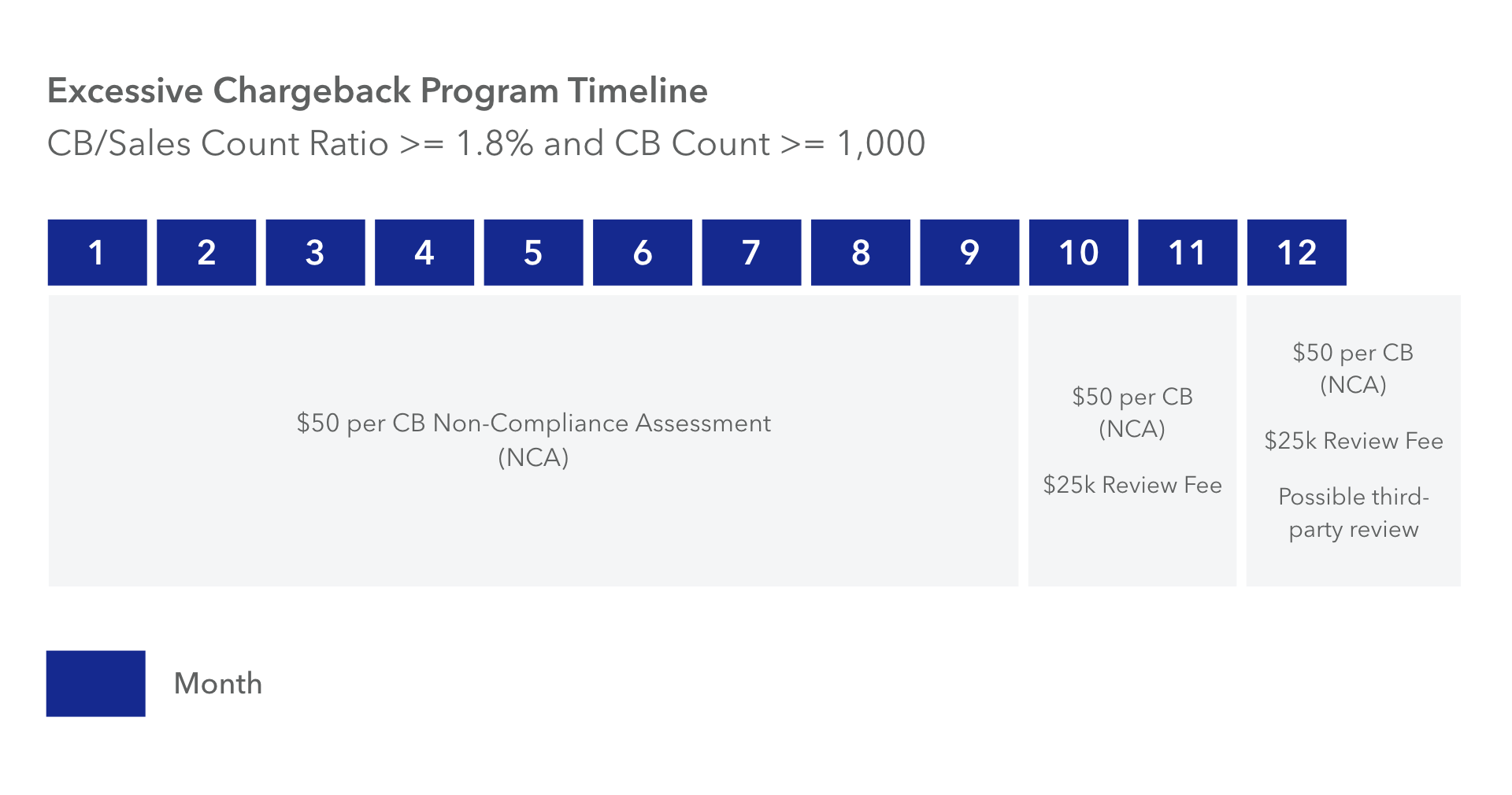

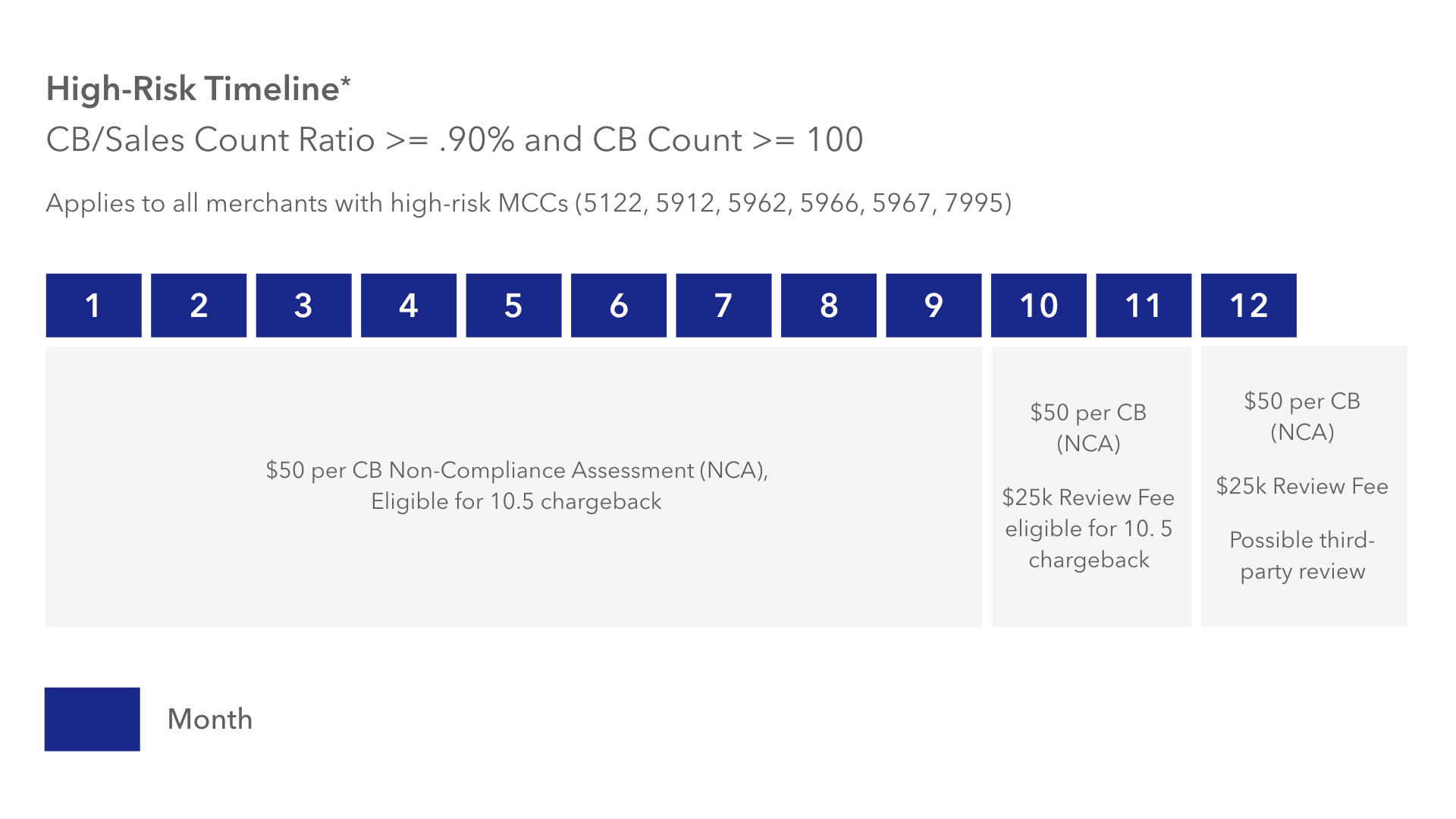

Program timelines

*The account status can be pushed from Standard to High-Risk timeline at Visa’s discretion. This action is based on a review of the account’s performance and/or inappropriate business practices.

*The account status can be pushed from Standard to High-Risk timeline at Visa’s discretion. This action is based on a review of the account’s performance and/or inappropriate business practices.

Early warning notifications

Visa provides Acquirers with information on a monthly basis that can give merchants the opportunity to see their official Visa stats and take proactive measures before the account is potentially identified in a fine-eligible chargeback program. There are no fines at the early warning threshold. Early warning notifications will be emailed to merchants when the following thresholds are reached:

75 or more chargebacks and 0.65% or more chargeback-to-sales count ratio

Please note that if the account meets or exceeds thresholds for the standard chargeback program, it may skip early warning notifications altogether.

Visa Fraud Monitoring Program (VFMP) updates

Updated thresholds — effective October 1, 2019

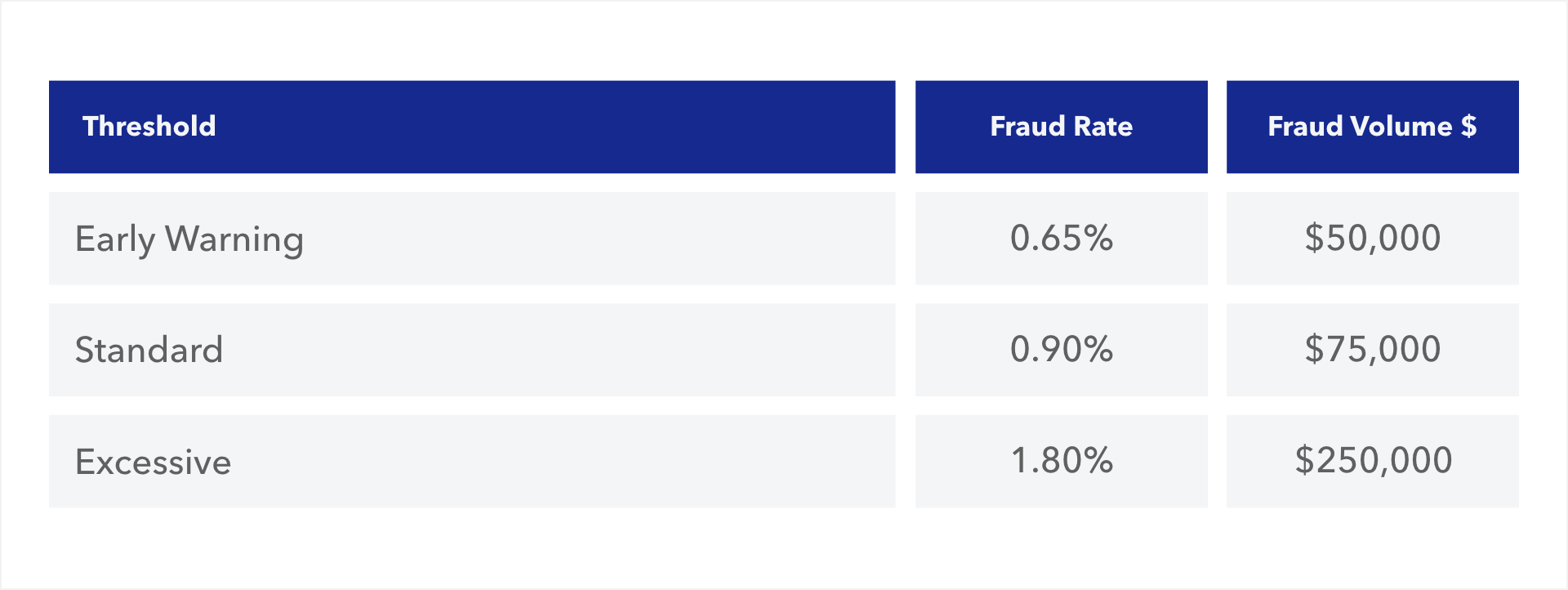

The VFMP program reviews the previous month’s reported fraudulent transactionsTransactions transactions Interactions where value is exchanged for goods or services. against that month’s sales transactions. If the account’s fraudulent transactions are greater than or equal to the following thresholds, it will enter Visa’s Fraud Program:

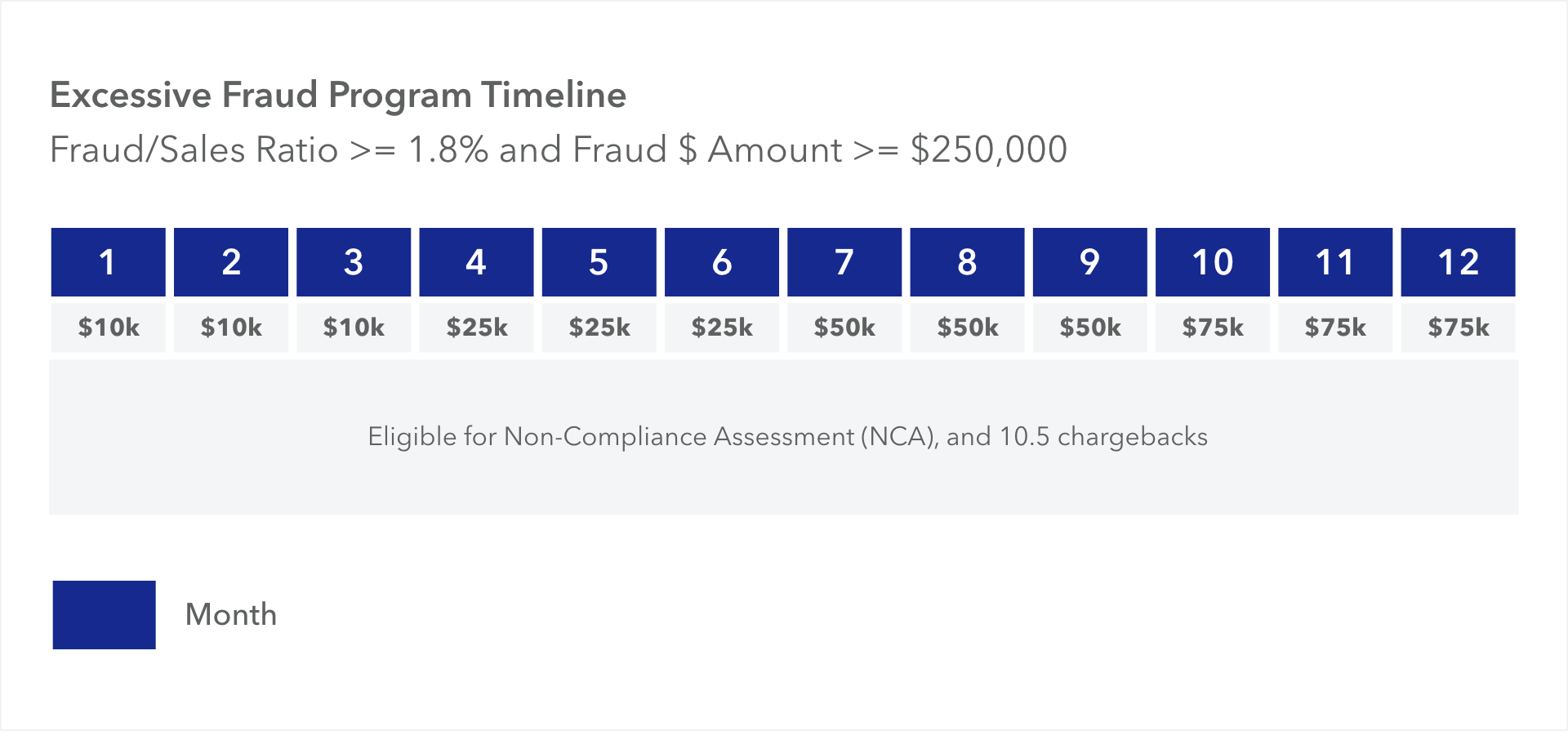

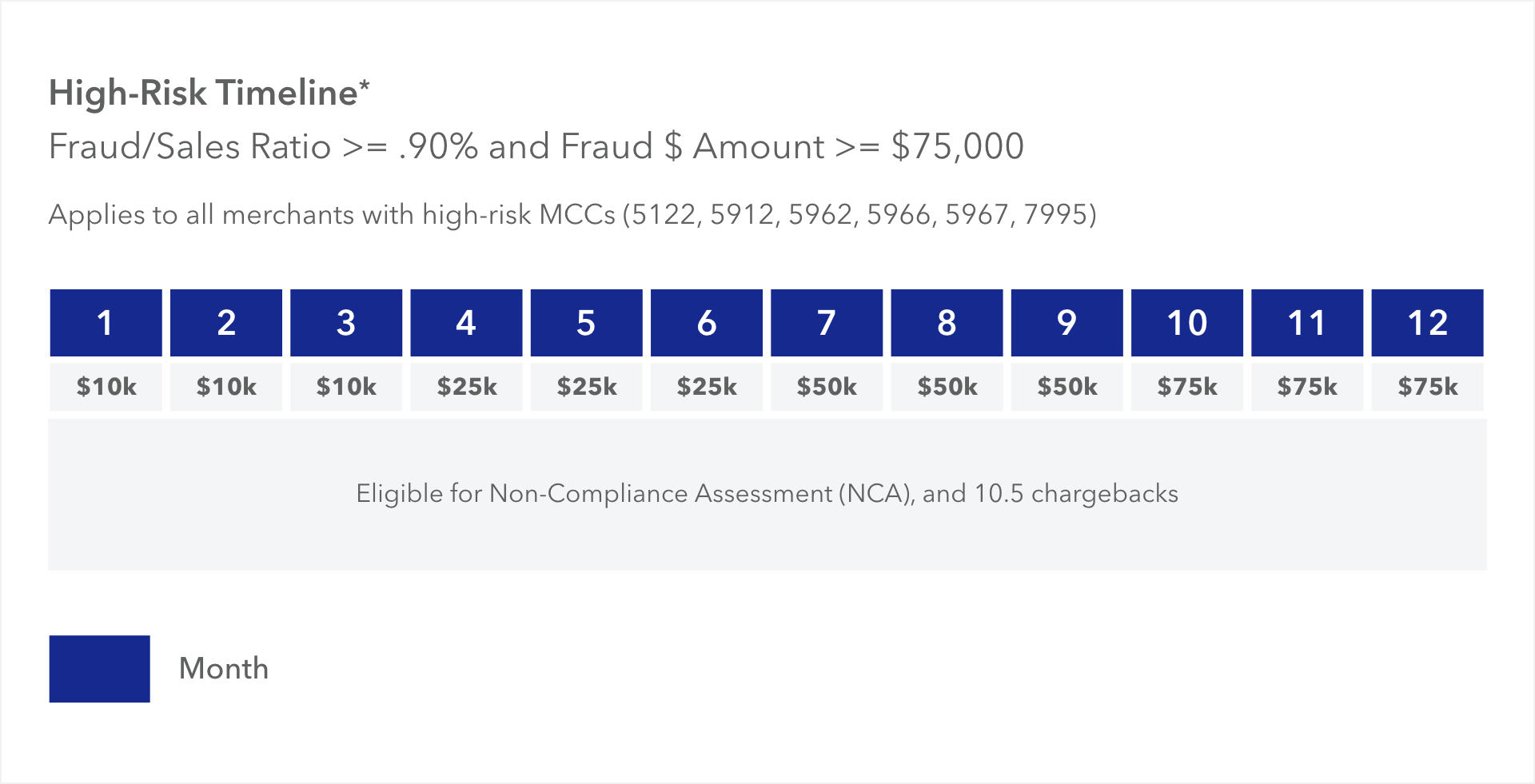

Updated Program Timelines

*The status can be pushed from Standard to High-Risk timeline at Visa’s discretion. This action is based on a review of the account’s performance or inappropriate business practices.

*The status can be pushed from Standard to High-Risk timeline at Visa’s discretion. This action is based on a review of the account’s performance or inappropriate business practices.

Early warning notifications

Visa provides Acquirers with information on a monthly basis that can give merchants the opportunity to see official Visa stats and take proactive measures before the account is potentially identified in a fine eligible fraud program. There are no fines at the early warning threshold. Early warning notifications will be emailed to merchants when the following thresholds are reached:

$50,000 or more in reported fraud and 0.65% or more in fraud-to-sales amount ratio

Please note that if the account exceeds thresholds for the standard fraud program, it may skip early warning notifications altogether.

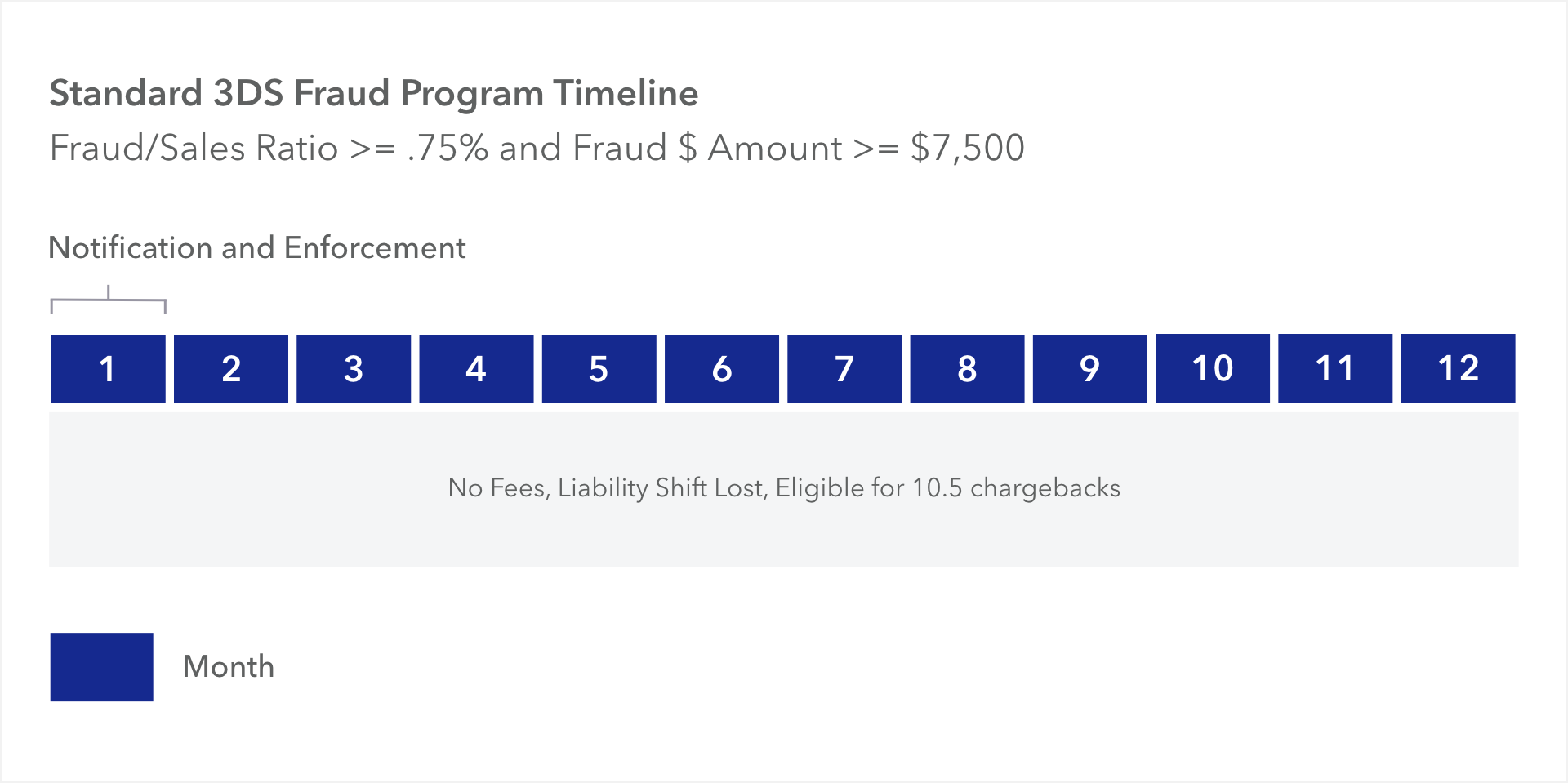

Visa Fraud Monitoring Program-3DS (VFMP-3DS)

Thresholds — effective October 1, 2018

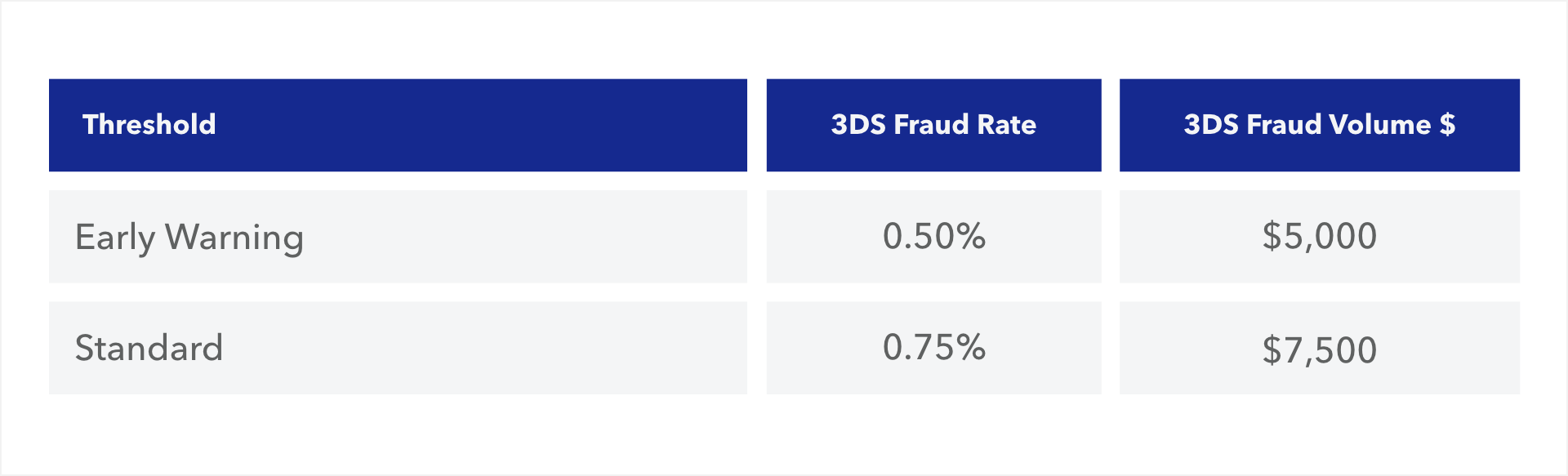

The VFMP-3DS program reviews the previous month’s reported fraudulent transactions against that month’s sales transactions. This program is only applicable to merchants that have accounts domiciled in the United States, and only 3DS traffic is calculated. If the account’s 3DS fraudulent transactions are greater than or equal to the following thresholds, the account will enter Visa’s 3D-Secure Fraud Program:

Timelines

If a merchant hits Month 1 Standard of the VFMP-3DS program, they will immediately lose liability shiftLiability Shift liability-shift A risk transfer where the party not supporting EMV or 3-D Secure bears the cost of fraudulent transactions. protections on their Visa 3DS transactions until the account is removed from the program. To exit the program, merchants must be below Standard Thresholds for three consecutive months.

Early warning notifications

Visa provides Acquirers with information on a monthly basis that can give merchants the opportunity to reduce fraud levels before the account is identified in this program. Early warning notifications will be emailed to merchants when the following thresholds are reached:

$5,000 or more in reported 3DS fraud and 0.50% or more in 3DS fraud-to-sales amount ratio

Please note that if the account exceeds thresholds for the standard fraud program, it may skip early warning notifications altogether.

VDMP and VFMP/VFMP-3DS caps

VDMP chargeback cap

Visa will cap the total number of chargebacks at 10 per card number and merchant account. For example, if there were 50 chargebacks received for a single card under one merchant account, just 10 of them would be counted in the VDMP.

VFMP/VFMP-3DS fraud cap

Visa will cap the total number of reported fraud transactions at 10 per card number and merchant account. For example, if there were 50 fraud transactions received for a single card under one merchant account, just 10 of them would be counted in the VFMP or VFMP-3DS.

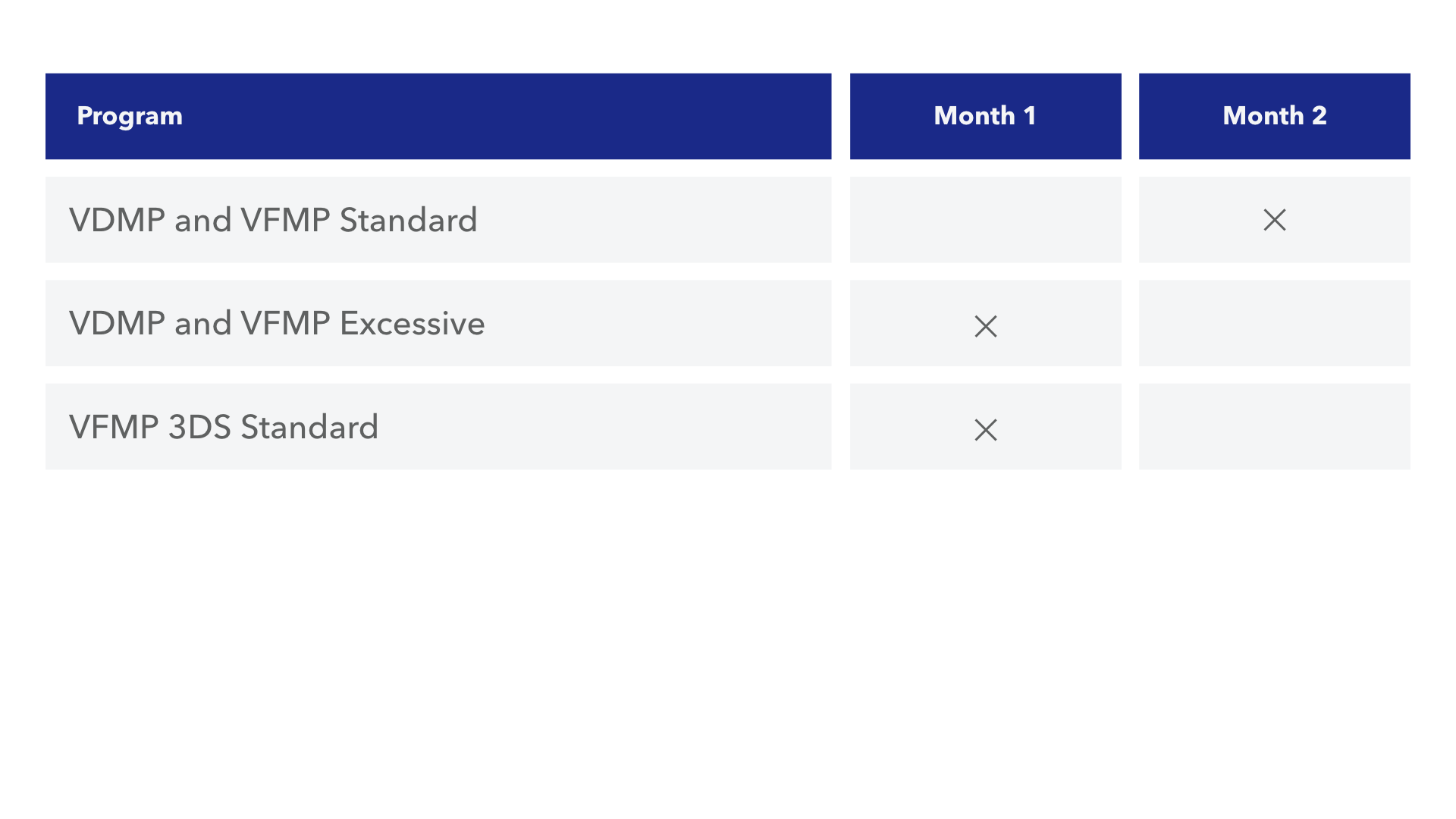

When the account hits the following thresholds and months, a remediation plan is due:

The goal of a remediation plan is to show Visa that steps are being taken to mitigate fraud and chargebacks. We’ll ask for the following details when a remediation plan is due:

- Business description

- Events leading to the increased chargebacks and fraud

- Actions taken to reduce chargebacks and fraud, including implementation dates

- Description of all fraud tools currently enabled

Vibhu is a global payments leader and PhD researcher in real-time payments, dedicated to making payments simpler, smarter, and more inclusive. With 20 years of payments experience across Citibank, Adyen, IKEA, Snapdeal, iPayLinks — and markets spanning India, China, Southeast Asia, Europe, and Australia— he brings a truly global perspective to the future of money. Vibhu is also the founder of PaymentsPedia.com, a knowledge hub where he shares insights on cards, crypto, cross-border flows, and real-time rails.📧 vibhu@paymentspedia.com | LinkedIn