How American ExpressAmerican Express american-express A global financial services corporation offering credit cards, charge cards, travel-related services, and merchant acquiring., M-PESA, and WeChat Power Closed-Loop Systems

While most global card payments operate through a four-party model (VisaVisa visa

A leading global payment technology company connecting consumers, businesses, and banks., MastercardMasterCard mastercard

A global payments network enabling electronic transactions between banks, merchants, and cardholders.), there’s another powerful structure — the Three-Party Model.

In this setup, a single payments provider plays the role of both the issuerIssuer issuer

A bank or financial institution that issues payment cards to consumers. Responsible for authorizations and chargebacks. and the acquirerAcquirer acquirer

A financial institution or payment processor that manages the merchant account, enabling businesses to accept card payments. Acquirers receive all transactions from the merchant and route them to the appropriate issuing bank., managing the customer, the merchantMerchant merchant

An individual or business that accepts payments in exchange for goods or services., and the transaction ecosystem end-to-end.

Companies like American Express, M-PESA, WeChat Pay, and Paytm have successfully deployed this model to create closed-loop payments systems with tighter control over the user experience, fees, and data.

🧩 What is the Three-Party Model?

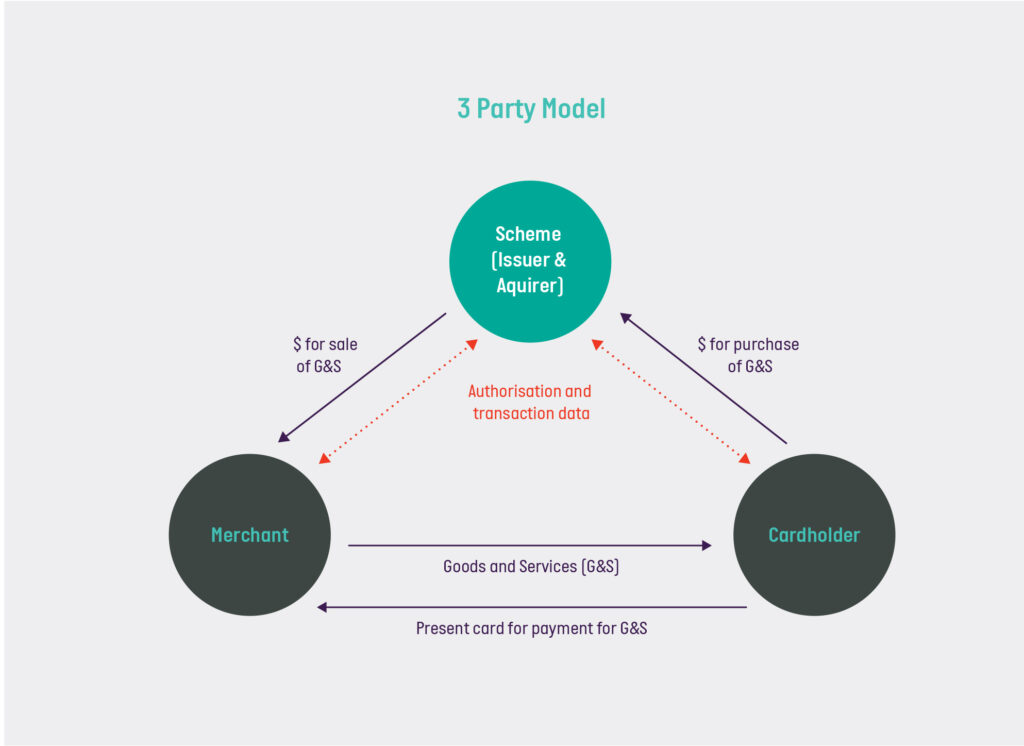

In a Three-Party Payments Model, three main parties interact — but one entity (the network) plays a dual role:

| Entity | Role | Description |

|---|---|---|

| Customer | Buyer | The individual making a purchase using a card, wallet, or account issued directly by the network. |

| Merchant | Seller | The business accepting payments through the same network’s acquiring setup. |

| Payment Network | Issuer + Acquirer | The same entity that issues customer accounts/cards and provides payment acceptance facilities to merchants. |

Unlike the four-party model, there’s no independent issuing bank or separate acquiring bank — everything is handled by the same organization.

🔄 How a Transaction Flows in the Three-Party Model

Here’s how the payment journey looks under a three-party system:

- Purchase Initiation:

The customer pays using an account/card/wallet issued by the network itself (e.g., Amex Card, WeChat Wallet). - AuthorizationAuthorization authorization

The real-time process of verifying that a payment method has sufficient funds or credit limit for a transaction. Results in an authorization code from the issuer. and Processing:

The network (American Express, M-PESA, etc.) immediately authorizes and processes the transaction in-house. - SettlementSettlement settlement

The process of transferring funds from the issuer to the acquirer.:

Funds are moved internally — from the customer’s account to the merchant’s settlement account maintained within the same system. - Merchant Payout:

The network credits the merchant (usually next day or according to its own settlement terms).

🔗 Examples of Three-Party Model Providers

| Payments Provider | Region / Focus | Official Website |

|---|---|---|

| American Express | Global credit cards and merchant services | USA, Global |

| M-PESA | Mobile money platform | Kenya, Africa |

| WeChat Pay | Digital wallet within WeChat ecosystem | China |

| Paytm | E-wallet and payments bank | India |

| Discover Network | Credit card network and merchant services | USA |

These providers issue accounts, acquire merchants, process transactionsTransactions transactions Interactions where value is exchanged for goods or services., and manage settlement — all under one roof.

📊 Three-Party Model vs Four-Party Model

Here’s how the Three-Party Model compares with the Four-Party Model:

| Aspect | Three-Party Model | Four-Party Model |

|---|---|---|

| Issuer and Acquirer | Same entity | Separate banks |

| Merchant Relationships | Direct with network | Through acquiring banks |

| Example Networks | Amex, M-PESA, WeChat Pay | Visa, Mastercard |

| Control Over Fees | Full control by network | Split between issuer and acquirer |

| Customer Data Ownership | Complete (network sees both sides) | Shared between banks and network |

| Flexibility for Merchants | Lower (must work with network terms) | Higher (can choose acquirer) |

🚀 Advantages of the Three-Party Model

- Tighter Control:

The payments provider can control pricing, rules, loyalty programs, and settlement timelines end-to-end. - Integrated Customer Experience:

Seamless linking of issuance, authorization, fraudFraud fraud Criminal deception involving unauthorized payments or use of financial credentials. prevention, and merchant servicing. - Data Ownership:

The network gains complete visibility into both customer and merchant behavior, enabling powerful analytics. - Speed and Efficiency:

Internal authorization and settlement are often faster because there’s no dependency on multiple external entities.

⚠️ Challenges of the Three-Party Model

- Scaling Globally:

Since the network must build both issuance and acquiring relationships from scratch, scaling outside the home market is harder. - Merchant Resistance:

Merchants may be reluctant to accept if fees are perceived as higher (e.g., historically with American Express). - Limited Competition:

Customers and merchants have fewer options compared to the open model of Visa and Mastercard.

🌍 Further Reading

✍️ Conclusion

In the Three-Party Model, one network owns the entire payment journey — from card or wallet issuance to merchant settlement.

This control enables powerful customer experiences and data-driven strategies but requires huge investments in both customer acquisition and merchant partnerships.

As mobile walletsWallets wallets

See Digital Wallets., super-apps, and alternative payment methods grow globally, three-party models are gaining renewed relevance — especially in emerging markets.

At PaymentsPedia, we continue to track the evolution of both open-loop and closed-loop payment models across the world.

In a three-party model, exemplified by American Express and by e-wallet providers such as M-PESA, WeChat, and Paytm, the same payments provider plays the role of both issuer and acquirer, providing accounts and payments hardware to both merchants and consumers. Hence it sets the rules and prices, authorizes and processes transactions, moves funds from the customer to the merchant, and so forth—all in-house.

In a given transaction, after (1) the customer authenticates a payment (2) the merchant submits it to the payments provider, which authorizes the transaction directly; (3) the payments provider then debits the consumer’s account and (4) credits the merchant’s account, minus the merchant discount fee.

In a three-party model, the provider can draw value from having control and visibility over both sides of the market. For instance, having full insight into transaction records for both merchants and consumers can enhance data analytics capabilities, including fraud monitoring. The provider can also make selectivity a source of competitive advantage, allowing American Express, for example, to negotiate MDRs from merchants on the acquiring side thanks to having pursued a higher-income clientele on the issuing side of the business