Payments: From Cowries to Cards to QR and Crypto

Payments are the beating heart of commerce. From the ancient barter systems and shells to the click-and-pay experiences of today, how we pay has always shaped how we live, trade, and grow economies. This blog takes you on a journey through the evolution of payments—from cowries and coins to cheques, cards, walletsWallets wallets See Digital Wallets., and crypto.

1. The Origins: Cowries, Barter, and the Birth of Money

Before money, barter ruled—swapping goods and services directly. But as trade grew more complex, cowries became the first global currency due to their portability and rarity. These were later replaced by metallic coins in Lydia (~600 BCE), enabling the first standardized state-issued money.

More on cowry shells →

History of coins →

2. Paper and Promises: Notes and Cheques

Paper currency emerged in 7th-century China under the Tang dynasty, followed by the introduction of cheques in the Islamic world around the 9th century. Both helped scale trade without needing to carry metal money.

Harvard History of Money in China →

Cheque history on Wikipedia →

3. Plastic Revolution: Credit and Debit Cards

The mid-20th century saw the rise of credit cards (Diners Club, 1950) and debit cards (1980s), leading to the four-party payment model we use today.

Visa’s history →

4. Going Digital: Online PaymentsOnline Payments online-payments Transactions conducted over the internet using card details, digital wallets, or online banking. and Wallets

With the internet boom, players like PayPal (1998) enabled digital checkout for eCommerceeCommerce ecommerce

Commercial transactions conducted electronically on the internet. Includes digital payments, shopping carts, and fraud prevention.. Mobile wallets (Apple Pay, Google Pay, Alipay) emerged post-2010, using tokenization and NFC for secure tap payments.

Federal Reserve on Wallet Usage →

5. The Rise of Real-Time and QR Payments

Today, real-time payments (RTP) like India’s UPI, Australia’s NPP, and Singapore’s PayNow move funds instantly, 24/7. QR codes provide a cost-effective, contactless way to pay—especially in emerging markets.

BIS Report on QR Payments →

6. Crypto and BNPL: The Frontier of Decentralized and Deferred Payments

BitcoinBitcoin bitcoin

A decentralized digital currency, often accepted as an alternative payment method.’s launch in 2009 ushered in crypto paymentsCrypto Payments crypto-payments

Payments made using cryptocurrencies such as Bitcoin, Ethereum, or stablecoins, often processed through crypto wallets or exchanges., allowing peer-to-peer value transfer with no intermediaries. Meanwhile, Buy Now Pay Later (BNPL) services offer credit-like functionality for digital natives.

MIT Digital Currency Initiative →

ECB Digital Euro →

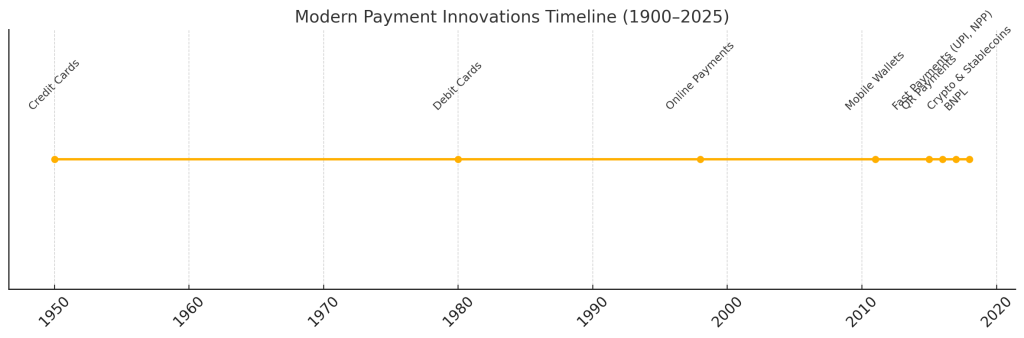

📊 Modern Timeline: 20th Century to Now

The last century has seen rapid innovation—from the invention of credit cards to today’s multi-rail ecosystems. Here’s a visual timeline of the most significant modern payment milestones:

7. Conclusion: Payments Will Keep Evolving

From barter and cowries to crypto and QR, payments are not just about tech—they’re about trust, speed, convenience, and inclusion. As innovation continues, we can expect payments to become even more invisible, embedded, and intelligent.