When a customer taps, dips, or swipes their card at a store, it triggers a sophisticated system working behind the scenes. One of the most widely adopted frameworks for processing payments globally is the Four-Party Model, exemplified by giants like Visa and Mastercard.

This model ensures that funds move seamlessly and securely from the customer to the merchantMerchant merchant An individual or business that accepts payments in exchange for goods or services. — but it involves more players than many realize.

Let’s break it down.

🧩 What is the Four-Party Model?

In the Four-Party Payments Model, four main entities interact to complete a transaction:

| Entity | Role | Description |

|---|---|---|

| Customer | Buyer | The person making a purchase using a payment instrument (typically a credit or debit cardDebit Card debit-card A payment card that deducts money directly from a consumer’s checking account. May also support ATM withdrawals.). |

| Issuing Bank | Customer’s Bank | The bank that issued the payment card and holds the customer’s funds or credit line. |

| Merchant | Seller | The business accepting payment for goods or services. |

| Acquiring Bank | Merchant’s Bank | The bank that provides payment acceptance facilities to the merchant and processes transactionsTransactions transactions Interactions where value is exchanged for goods or services. on their behalf. |

Each party plays a critical role in authorizing, processing, clearingClearing clearing The exchange of financial information and instructions between acquirers and issuers to facilitate settlement., and settling the payment.

🔄 How a Transaction Flows in the Four-Party Model

Here’s a simplified flow of what happens when a customer makes a card payment:

- Purchase Initiation:

The customer presents their card at the merchant’s checkout (physical POS terminal or online checkout). - AuthorizationAuthorization authorization

The real-time process of verifying that a payment method has sufficient funds or credit limit for a transaction. Results in an authorization code from the issuer. Request:

The merchant’s POS device sends an authorization request through the acquiring bank to the card network (VisaVisa visa A leading global payment technology company connecting consumers, businesses, and banks./MastercardMasterCard mastercard A global payments network enabling electronic transactions between banks, merchants, and cardholders.), and then to the issuing bank. - Authorization Response:

The issuing bank checks if funds or credit are available and sends an approval or decline response back through the network to the merchant. - Clearing and SettlementSettlement settlement

The process of transferring funds from the issuer to the acquirer.:

At the end of the day, the transaction is cleared (information about the transaction is processed) and settled(funds are transferred from the issuing bank to the acquiring bank, minus applicable fees). - Merchant Receives Funds:

The merchant gets paid (typically minus a Merchant Discount RateDiscount Rate discount-rate A percentage fee charged by acquiring banks on each transaction processed. Typically includes interchange and processor fees. or MDR fee) into their account by their acquiring bank.

🔗 Key Supporting Entities Behind the Model

While the core four parties are essential, several additional players often support the ecosystem:

| Entity | Role | Examples / URLs |

|---|---|---|

| Card Networks | Facilitate transaction routing and rules | Visa, Mastercard |

| Payment Gateways | Help connect merchant systems to acquirers | Stripe, Adyen, Checkout.com |

| Payment Processors | Handle technical processing of transaction data | FIS, Fiserv, Global Payments |

| Payment Facilitators (PayFacs) | Aggregate multiple merchants under one master account | Square, Shopify Payments |

These entities ensure the four-party model operates efficiently at scale.

📊 Four-Party Model vs Three-Party Model

It’s important to distinguish the Four-Party Model from the Three-Party Model, used by companies like American Express and Discover:

| Aspect | Four-Party Model (Visa/Mastercard) | Three-Party Model (Amex/Discover) |

|---|---|---|

| IssuerIssuer issuer A bank or financial institution that issues payment cards to consumers. Responsible for authorizations and chargebacks. and AcquirerAcquirer acquirer A financial institution or payment processor that manages the merchant account, enabling businesses to accept card payments. Acquirers receive all transactions from the merchant and route them to the appropriate issuing bank. | Separate entities | Same entity |

| Example Banks | Issuer: Chase; Acquirer: Worldpay | American ExpressAmerican Express american-express A global financial services corporation offering credit cards, charge cards, travel-related services, and merchant acquiring. acts as both |

| Merchant Relationships | Through Acquirers | Direct with American Express |

| Control Over Fees | Shared between Acquirer and Issuer | Direct control by Network |

In the Three-Party Model, the network acts as both issuer and acquirer, allowing tighter control over merchant fees but limiting openness compared to the four-party model.

🚀 Why the Four-Party Model Dominates

- Openness and Scale: Any bank can join as an issuer or acquirer, driving global reach.

- Competition Encouraged: Merchants and consumers benefit from multiple choices of banks and cards.

- Innovation: Acquirers, gateways, and issuers innovate independently, enabling rapid product development.

Today, Visa and Mastercard dominate global payment rails precisely because of the flexibility and scalability enabled by the four-party framework.

The next time you swipe your card or tap your phone, remember:

You’re not just paying the merchant — you’re activating a carefully choreographed dance between banks, networks, and service providers.

The Four-Party Model keeps this entire complex system secure, reliable, and fast — across the globe.

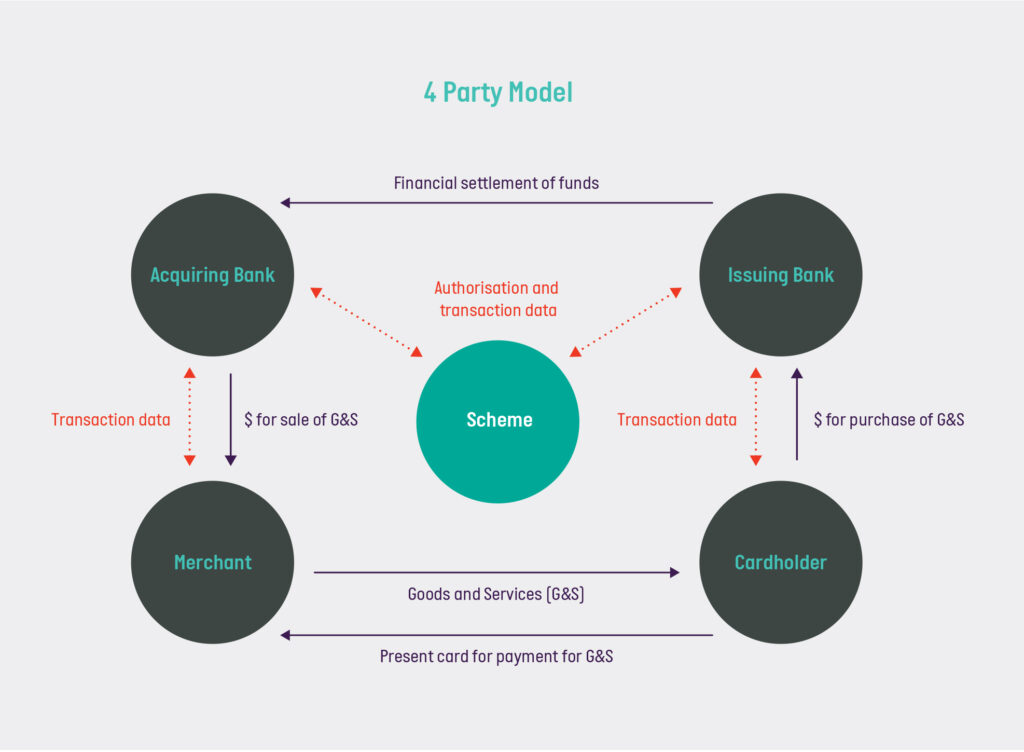

PS: Diagram of the 4 party model

In a transaction, (1) the customer swipes the card and authenticates the payment, after which (2) the merchant sends the transaction to the acquiring bank, (3) which in turn processes the transaction by passing it to the relevant payments network (e.g., Visa or Mastercard), and the network, which also sets the overall rules for the payments scheme, runs automated fraudFraud fraud Criminal deception involving unauthorized payments or use of financial credentials. checks and forwards the transaction to the issuing bank for authorization.

If the issuing bank authorizes the transaction, (4) it debits the customer’s account and (5) settles the payment to the acquiring bank, minus an interchange fee. Finally, (6) the acquiring bank pays the merchant, minus a merchant discount fee, which covers the acquiring costs, including interchange, terminal depreciation, risk, merchant servicing, operating expense, and some profit margin for the acquirer itself.

Difference vs the Three-Party Model

In a four-party model, the transaction feeTransaction Fee transaction-fee Charges incurred per individual transaction by the merchant. relating to a merchant payment typically must be split among the issuer, the acquirer, and the payments network. In a three-party model, the payments provider doesn’t need to share revenue with anyone else; it retains the entire transaction fee. Since MDRs are not necessarily lower for three-party models, this can mean higher margins for payments providers. However, the three-party model also requires the issuer to grow its own merchant network, which increases the cost and challenge of scaling.