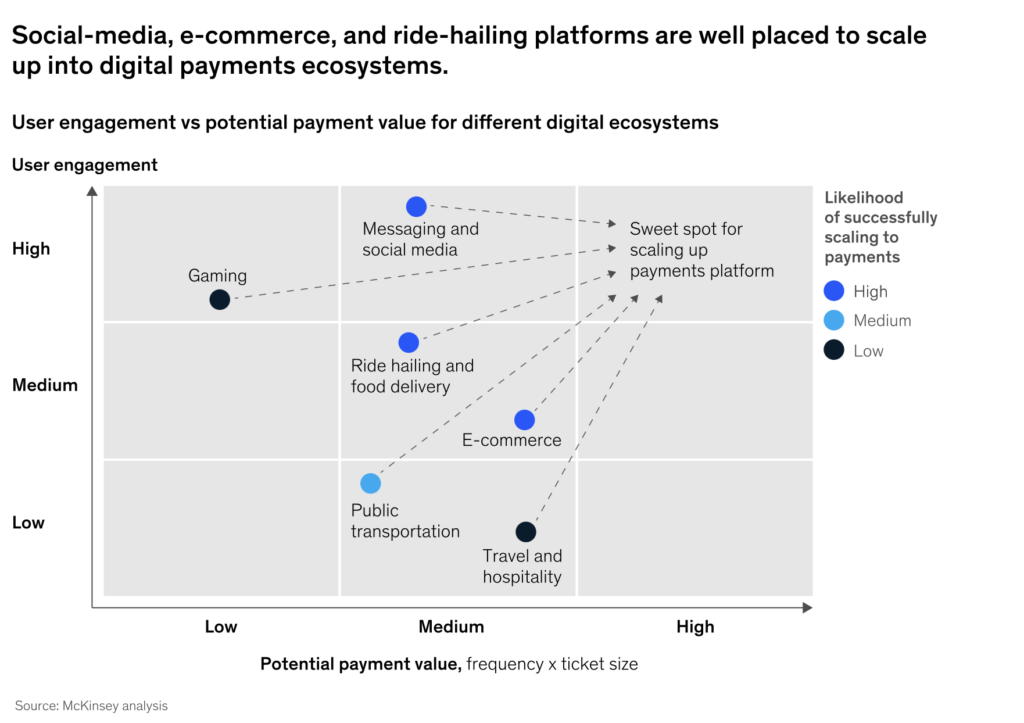

A McKinsey Report finds that WalletsWallets wallets See Digital Wallets. are more embedded in customers’ daily lives when they are part of ecosystems. This enables them to grow by extending into e-commerce, ride-hailing, food delivery, messaging, travel, and other adjacent categories. For instance, prominent ride-hailing players in Southeast Asia, such as Grab and Gojek, are looking to capitalize on their high-frequency use and rich customer data by extending into groceries and other categories with larger ticket sizes. Players with higher ticket sizes but lower frequency of use, including e-commerce platforms Jumia in Africa and Shopee in Southeast Asia, are pushing in the opposite direction, seeking to boost user engagement through gamification and other approaches.

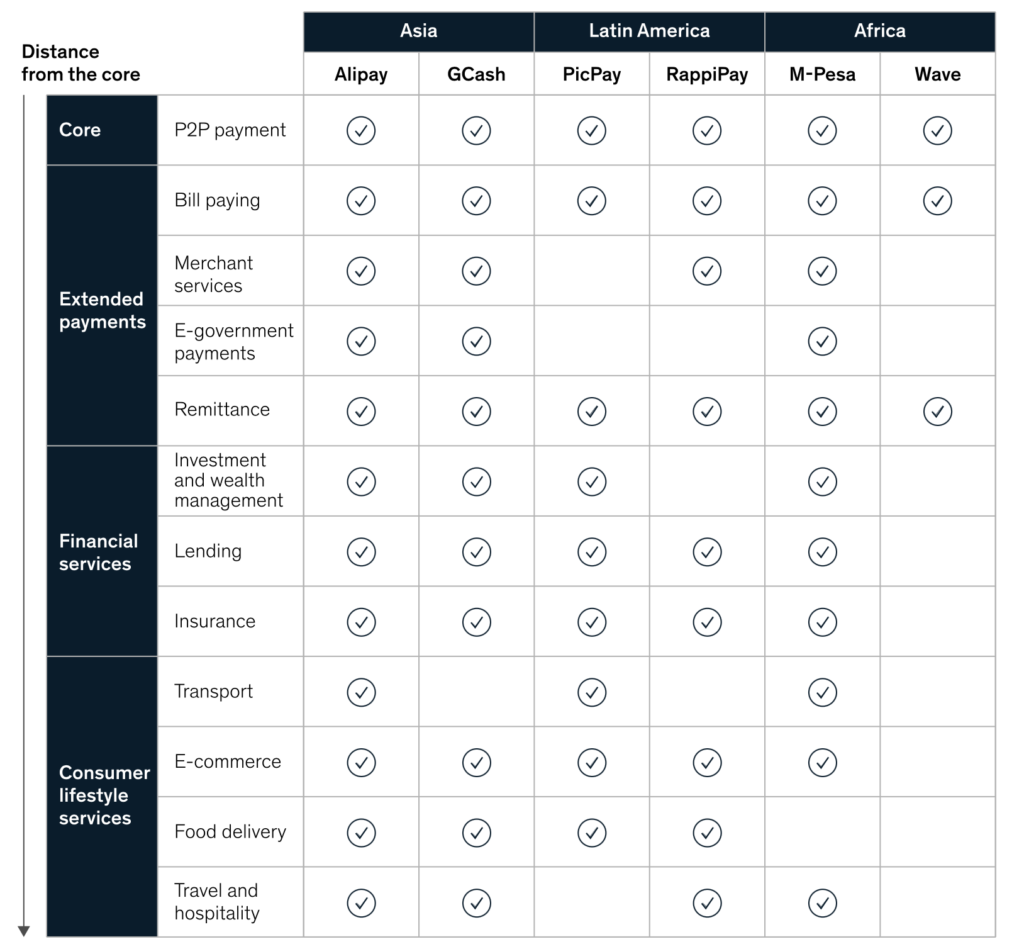

In Africa, M-Pesa morphed from a mobile money service into an ecosystem by forming partnerships to create a super app with seamlessly integrated mini apps in e-commerce, travel, health, agriculture, and other categories. User engagement and monthly revenue per user have risen, with more than a million monthly active users since the launch of the super app in 2021.16In Latin America, Rappi—a Colombia-based, on-demand delivery service with more than 30 million users and a presence in more than 100 cities in nine countries—has expanded its super app into offerings such as e-commerce, insurance, and loyalty points.

Wallets that are not part of an ecosystem involving e-commerce, social media, or ride hailing will find it tougher to succeed, since capturing customer mindshare is difficult when use cases are limited. Exceptions can be found, however, in markets where wallets have a significant first-mover advantage, such as MoMo in Vietnam.

Margins for digital payments providers are already wafer thin and are likely to be eroded further by competitive intensity and declining fees. In many cases, payments are more a means to cross-sell other products than a profit center in their own right. Some services, such as peer-to-peer (P2P) payments, are usually offered to users for free in most markets. In Brazil, for instance, Pix is pushing margins down by offering P2P payments for free and person-to-merchantMerchant merchant An individual or business that accepts payments in exchange for goods or services. (P2M) payments at low cost. One of the few providers charging for P2P payments is M-Pesa, but it is coming under increasing pressure to reduce its charges, especially after adjusting its fee structure as part of pandemic-relief efforts.

Not only do digital payments providers face squeezed margins, they also incur high acquisition and engagement costs because of the constant promotions needed to attract new customers and encourage more frequent use among the existing base. In addition, the cost of cash remains a challenge for wallets, though it is starting to come down as banking penetration improves. Globally, the majority of mobile wallets continue to post losses. However, they are exploring monetization paths to create profitable income streams and introducing innovative new features to broaden and deepen their customer base.