🔁 What Is Account Updater? VisaVisa visa A leading global payment technology company connecting consumers, businesses, and banks., MastercardMasterCard mastercard A global payments network enabling electronic transactions between banks, merchants, and cardholders. & Amex Card Update Services Explained

Imagine you’re a loyal Netflix subscriber. One day, your credit card expires or is reissued after being lost. Normally, this would disrupt your subscription. But—magically—you’re still being billed without lifting a finger. How? Account Updater Services.

Let’s break down what Account Updater is, how it works across Visa, Mastercard, and American ExpressAmerican Express american-express A global financial services corporation offering credit cards, charge cards, travel-related services, and merchant acquiring., and why it’s a game-changer for merchants, consumers, and issuers alike.

🧠 What Is an Account Updater Service?

Account Updater is an automated service offered by major card networks that allows merchants to receive updated card details (new card number, updated expiry date, etc.) when a customer’s card changes due to:

- Expiration

- Loss or theft

- Card reissuance

- Bank mergers or portfolio transfers

It enables uninterrupted payments for recurring billing, subscriptions, and stored credentials.

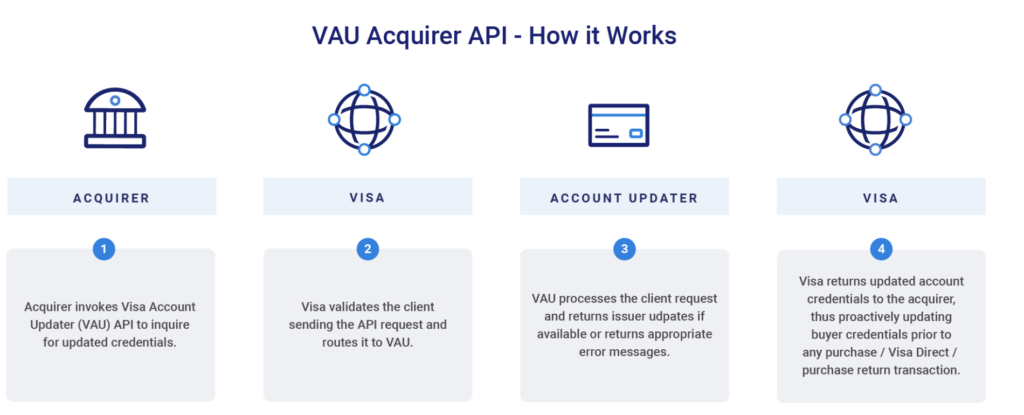

🛠️ How Does It Work?

- You subscribe to a service like Netflix or Spotify and save your card on file.

- Your card expires or is replaced.

- Your issuing bank shares your updated card info with the card network (e.g., Visa).

- The merchantMerchant merchant An individual or business that accepts payments in exchange for goods or services. or their payment processorProcessor processor A company authorized to process credit and debit card transactions between acquirers and issuers. uses Account Updater APIs to request updated card data.

- The network returns the new card number or expiry date.

- The subscription continues without disruption.

🧾 This all happens behind the scenes, and the cardholderCardholder cardholder The person or business to whom a payment card is issued. usually never needs to intervene.

🔗 Who Provides Account Updater Services?

| Network | Service Name | Merchant/Processor Link |

|---|---|---|

| Visa | Visa Account Updater (VAU) | https://usa.visa.com/… |

| Mastercard | Mastercard Automatic Billing Updater (ABU) | https://www.mastercard.us/… |

| American Express | Amex Cardrefresher / Amex Account Updater | https://www.americanexpress.com/… |

💡 These services are often integrated into payment processors and gateways like Adyen, Stripe, Braintree, and others.

🌍 Who Uses It and Why?

✅ Use Case: Netflix Subscriber with Lost Card

“I lost my credit card, and the bank sent me a new one. I forgot to update Netflix, but it kept billing me anyway!”

That’s Account Updater in action. Without it, Netflix would’ve received a decline, prompting the user to re-enter new card info (often leading to churn or payment failure).

📈 Benefits of Account Updater

| For Merchants | For Cardholders |

|---|---|

| Higher payment approval rates | Seamless experience across subscriptions |

| Reduced involuntary churn | No need to manually update card details |

| Fewer customer service calls | No service interruption |

| Better lifetime value of subscribers | Reduces missed payments & fees |

🔒 It’s also secure, as card data is exchanged between trusted parties via PCI-compliant networks.

🤝 Who Can Use It?

Account Updater is usually available to:

- Merchants using recurring billing or card-on-file models

- Processors and PSPs offering subscription payments

- Enterprise platforms with large customer bases

Some processors require explicit consent from merchants to enroll in the updater program.

🧩 Limitations and Considerations

- Not all issuers participate (especially smaller banks or regional cards)

- Not all card types (e.g., prepaid or gift cardsGift Cards gift-cards Prepaid cards issued by retailers or card networks that allow purchases up to the value loaded on the card.) are supported

- Updates can be periodic, not real-time (depending on processor)

- For Amex, the merchant must register directly or via a certified processor

📌 Conclusion

Account Updater services from Visa, Mastercard, and Amex are critical infrastructure for today’s subscription economy. They reduce friction, increase revenue, and improve user experience—all by quietly keeping your card data up-to-date.

Whether you’re a streaming platform, a SaaS company, or a gym with monthly billing—you need Account Updater.

Would you like me to create a downloadable infographic or card flow diagram to go along with this post?

If your company’s lifeline is recurring revenue, preventing customer churn is crucial to success. Subscription businesses stay afloat by maintaining a high uptime, reaching out to disengaged users and leveraging their current customer base for highly qualified referrals.

Until recently, it’s been nearly impossible to minimize the loss of revenue associated with outdated payment information. Account Updater, a service which provides companies that rely on recurring billing with up-to-date financial information on customers, can ensure that your revenue stream remains as stable as possible.

Why Account Updater Matters

While very little data is available on how often a typical customer will update their billing address or credit card information, experts estimate that subscription businesses can expect to lose up to 5-10% of their business annually.

It’s not a matter of customer dissatisfaction or disengagement, but simply being unable to continue recurring billing on clients who haven’t updated their payment information. Manual follow-ups to receive accurate information from customers can be successful, but outreach can be costly for a SaaS company, especially if multiple attempts are required to make contact.

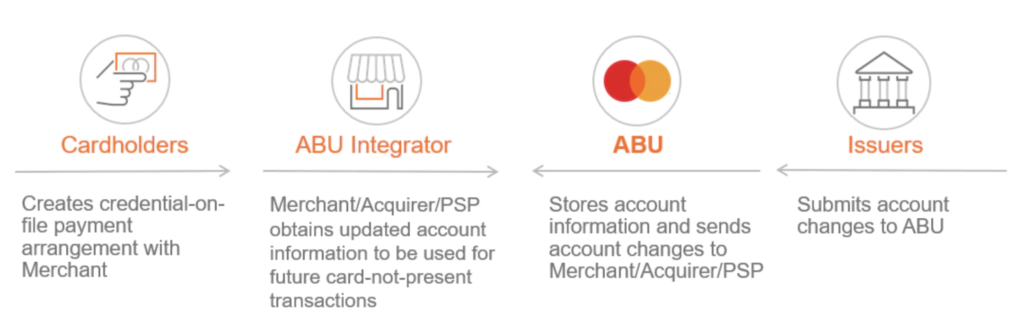

How it Works

A select number of payment processors can provide access to all account updates held by Visa or MasterCard. This is very useful for subscription businesses. If a customer orders a new payment card number, receives a new expiration dateExpiration Date expiration-date The month/year on a card beyond which it becomes invalid. Must be valid for the transaction to be authorized. or updates their billing address, the information is automatically updated.

This removes the need to individually contact customers whose payments have declinedDeclined declined A transaction that is not approved by the issuer. Reasons may include insufficient funds, suspected fraud, or incorrect card details., minimizing cost and providing less disruption to the revenue from recurring billing.

Benefits of the Program

Repeated declined payments can have a significant negative impact on SaaS companies. Manually updating payment information requires an enormous time investment from sales or customer service representatives. Finally, customers also benefit from having a positive payment experience with their SaaS subscriptions. There’s no disruption in their service and no need for them to reach out with updated information.

For subscription businesses and other companies that rely on recurring billing as a source for revenue, Account Updater is undoubtedly a positive change. Your monthly churn due to outdated payment information will be minimized.

Credits: Chargebee

Vibhu is a global payments leader and PhD researcher in real-time payments, dedicated to making payments simpler, smarter, and more inclusive. With 20 years of payments experience across Citibank, Adyen, IKEA, Snapdeal, iPayLinks — and markets spanning India, China, Southeast Asia, Europe, and Australia— he brings a truly global perspective to the future of money. Vibhu is also the founder of PaymentsPedia.com, a knowledge hub where he shares insights on cards, crypto, cross-border flows, and real-time rails.📧 vibhu@paymentspedia.com | LinkedIn